A trainee is a person undergoing a training program within an organization, after graduation from the higher and technical course. These trainees may be subsequently absorbed into the organization on completion of the training program.

In India, there are no specific laws that determine or include the word ‘trainees’. We can identify three types of people who undergo training. They are Trainees, Interns, and Apprentices.

Trainees

As mentioned earlier, trainees are those individuals, usually, freshers, who lack specific skills and who undertake the specified training as ‘trainees’. Upon completion of training, they may be absorbed into the organization if found fit. Stipend is paid during the period of training.

Interns

Interns are students who are undergoing their education but due to the requirement of the curriculum, undertake an internship program in an organization. An internship is a temporary position that is mandated in the course that they are undergoing. In most cases, interns do not receive any wages during the period of internship. There are, however, exemptions where interns are paid during their internship. However, paid internship is an exception.

Apprentices

An apprentice is a person who trains for a career by working under the supervision of a highly experienced individual or worker. The apprentices have a formal contract with the employer. The apprenticeship follows a clear plan and includes on-the-job training combined with an educational curriculum. The individual comes under the Apprentice Act, 1961. Apprentices are paid stipends ranging from Rs:9,000/- to a high of nearly Rs:21,000/-.

Labour Laws related to Trainees

In India, there are no specific labour laws that include trainees. A lot of confusion persists regarding whether they are eligible to receive the benefits that normal employees get. There are instances where trainees are looked upon as employees, and organizations that engage trainees should be aware of certain facts before engaging them.

Are trainees eligible for EPF?

A trainee is eligible to get the benefit of the EPF Act under certain circumstances. If the trainee is not a student and does not come under the Apprentices Act, 1961, then the trainee will be eligible for EPF deductions. This is subject to the trainee attracting Sec.2(b) and Sec.2(e) of the EPF Act.

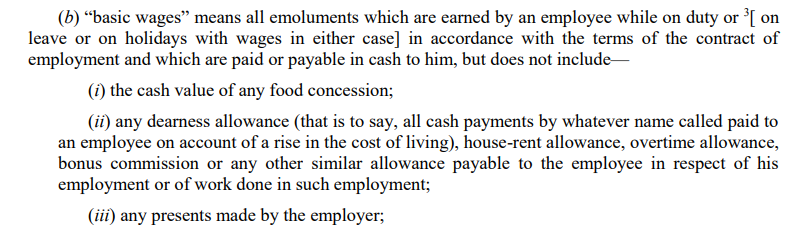

Section 2(b)

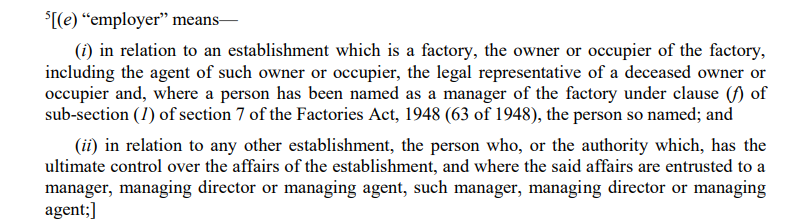

Section 2(e)

Are trainees eligible for ESIC?

Trainees are generally paid a stipend. If the trainee satisfies Sec.2(9) of the ESIC Act, then he is considered an employee and is eligible to be subjected to ESIC contributions.

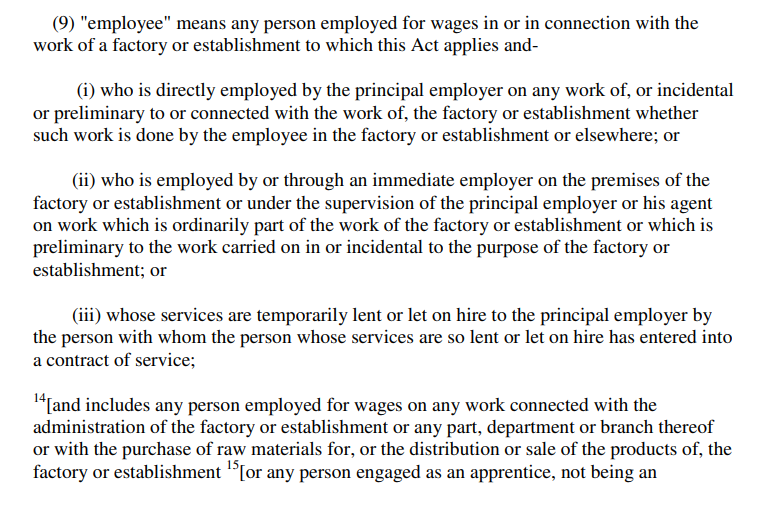

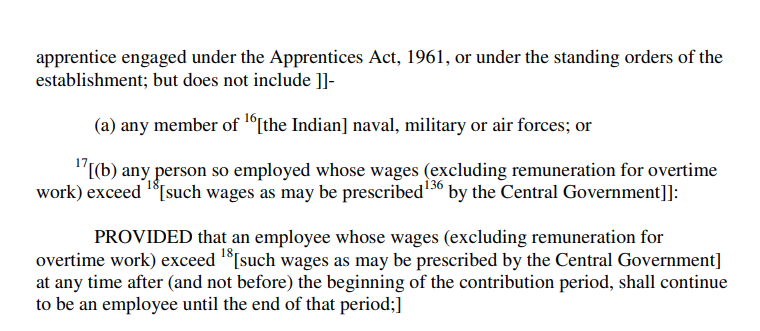

Section 2(9)

Are trainees subject to the Minimum Wages Act, 1948?

Trainees, especially in the private sector have to be paid the notified Minimum wages. The Minimum Wages Act contains a listing of the scheduled employment. As per the Act, temporary or probationers under scheduled employment must receive a minimum rate of wages as notified.

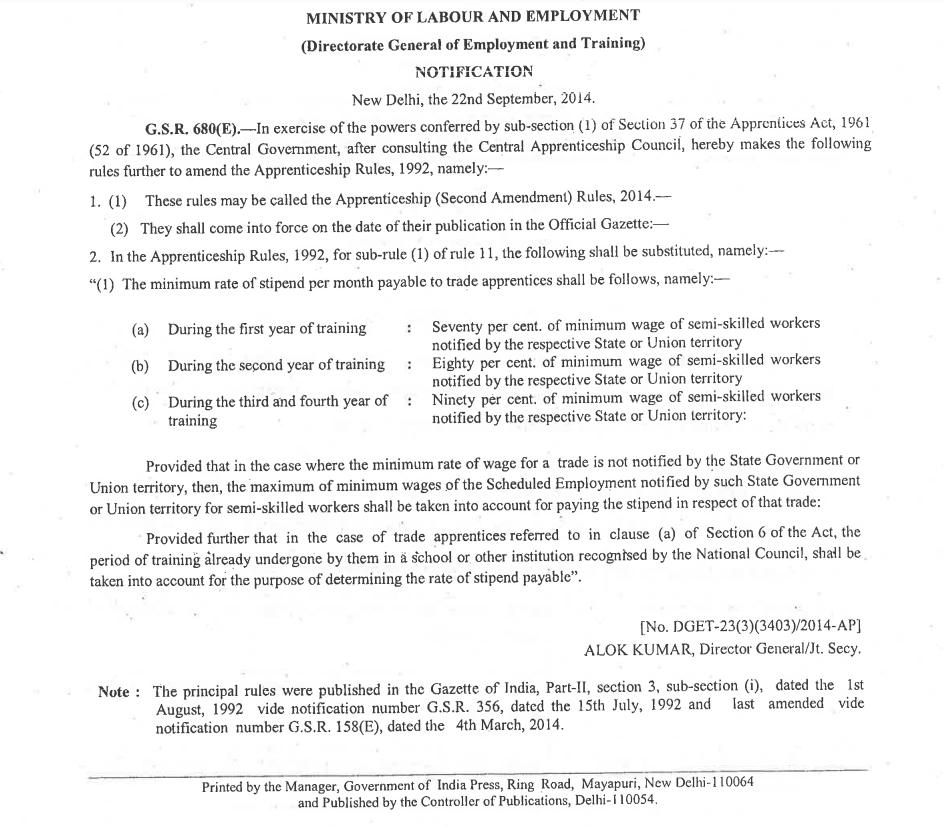

The Ministry of Labour and Employment, through its Notification G.S.R 680 (e) dated 22nd September 2014 notified the minimum wages to be paid to trade apprentices.

This minimum rate is calculated as a percentage of the salary of semi-skilled workers of the respective State or Union Territory. The percentages are as follows:

- 70% during the first year of training.

- 80% during the second year of training.

- 90% during the third and fourth year of training.

In the event of a State or Union Territory not notifying the minimum wages then the lowest minimum wages of the scheduled employment for semi-skilled workers shall be considered for calculating the stipend.

G.S.R 680 (e)

Are Trainees eligible for Bonus?

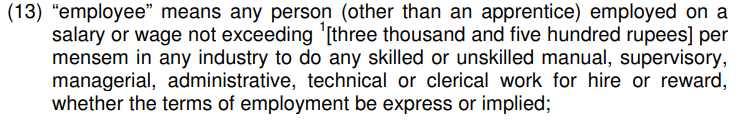

Where the trainees are engaged under the Apprentices Act, 1961, they will not be entitled to a Bonus under Sec. 2(13) of the Payment of Bonus Act, 1965. The Apprentice is not considered an ’employee’ and is, therefore, not eligible to receive a Bonus.

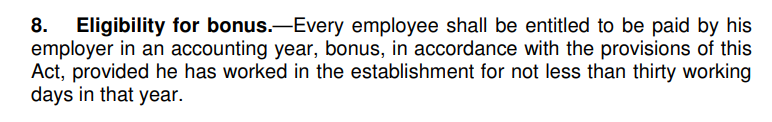

If the trainee has not been engaged under the Apprentice Act, 1961, then the trainee is eligible for a Bonus under the Payment of Bonus Act, 1965 subject to satisfying Sec.8 of the Act.

section 2(13)

section 8

Are Trainees eligible for Maternity benefits?

A trainee with one surviving child, engaged as an Apprentice under the Apprentices Act, 1961, may be granted maternity leave for 90 days from the date of its commencement without payment of the stipend, and the apprenticeship training period shall be extended accordingly.

The apprentice is eligible to receive the stipend during the extended period.

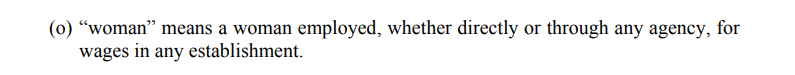

A woman trainee can also avail of the benefit under the Maternity Benefit Act, provided she satisfies Sec. 3(o) and Sec. 5(2) of the Act.

Section 3(o)

Section 5(2)

Conclusion

From the available information, we can understand that

- Trainees shall be considered for entitlement of EPF and ESI subject to them not being apprentices under the Apprentices Act, 1961.

- Apprentices engaged under the Apprentices Act, 1961 are not treated as ’employees’ under the ESIC Act, whereas a trainee can be treated as an ’employee’.

- Interns who are paid needn’t be considered for EPF and ESI, whereas unpaid interns have nothing to be deducted from as they do not receive any remuneration.

- Trainee women apprentices engaged under the Apprentice Act, 1961 who have one surviving child may be granted 90 days leave under the Maternity Benefit Act, 1961.

- Apprentices engaged under the Apprentices Act, 1961, or as per the Model Standing Orders, needn’t be considered for EPF.

- Trade Apprentices are eligible for Minimum Wages.

- Trainees in the scheduled employment as per the schedule of the Minimum Wages Act must receive a minimum of the notified rate.

GetifyHR has gained tremendous experience in handling these issues. Our Payroll Outsourcing Module is perfectly designed to handle all aspects of Payroll processing like generation of Payslips, Leave and Attendance, and Statutory requirements like EPF, ESI, PT, and TDS. Ours is a one-stop solution for all Payroll related issues.

Leave A Comment